Access to Capital

We specialize in connecting businesses with the right financing solutions to acquire the assets they need to thrive. With years of experience and a vast network of lenders and financial institutions, we are your trusted partner in navigating the complex landscape of asset finance.

We Drive Growth

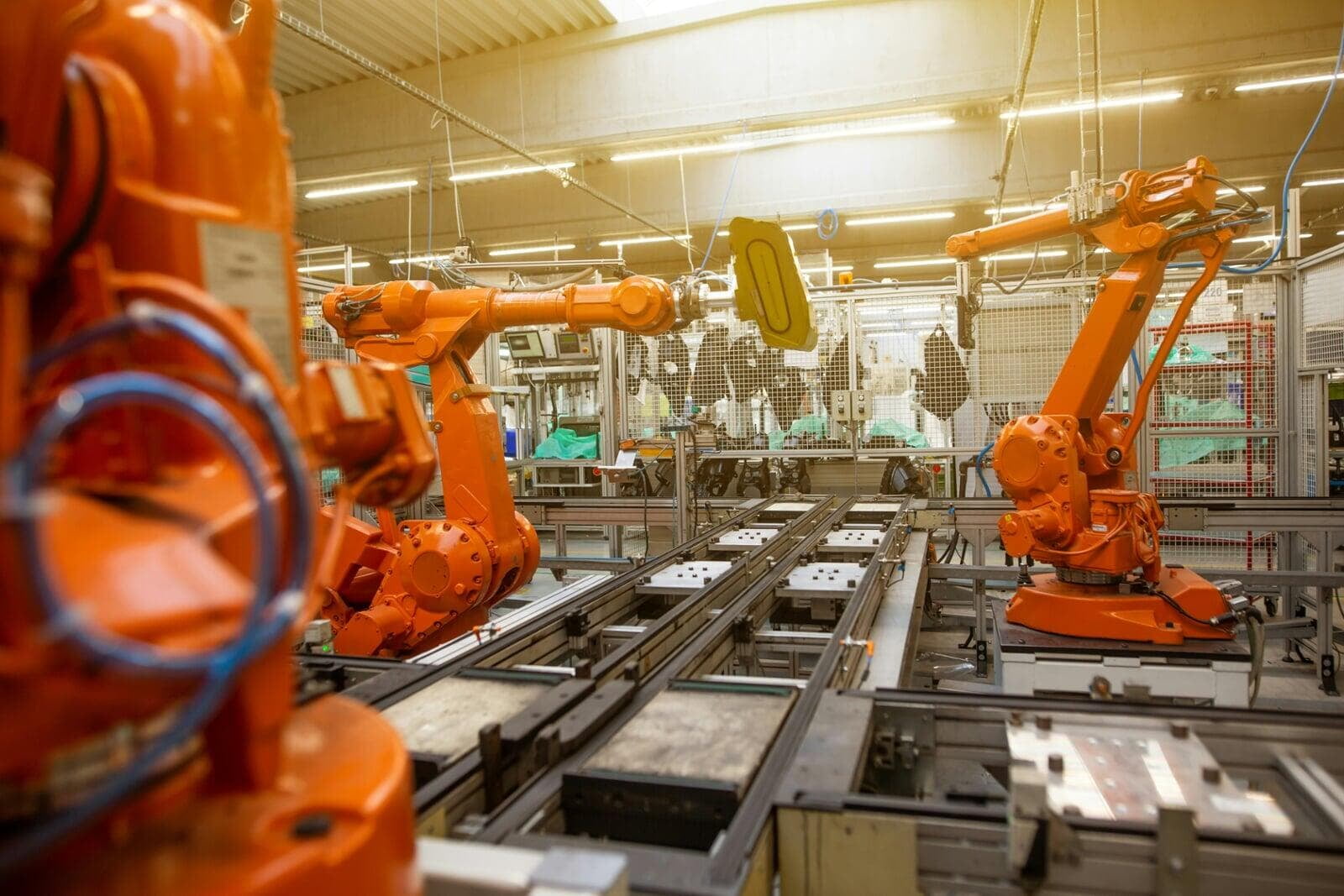

In today's fast-paced business environment, having access to the right assets is essential for driving growth and maintaining a competitive edge. Our asset finance product provides a flexible and efficient way for businesses to acquire the equipment, machinery, vehicles, and technology they need without tying up valuable capital or disrupting cash flow.

Contact Us

Whether you're a small startup or a large corporation, our asset finance product can help you unlock new opportunities for growth, efficiency, and success.

Contact us today to learn more about how FinNow can support your business with our innovative asset finance solutions.

With our asset finance solutions, businesses can:

Acquire Assets Easily

Business Expansion

Preserve Cashflow

Stay Up to Date

Flexible Terms